Dollar Stalls on JPY Drive

The US Dollar is starting the week under pressure. The DXY has fallen around 0.6% from last week’s highs across early European trading on Monday. Hawkish comments from BOJ’s Ueda have fuelled a narrowing of the US/Japan yield spread which is driving JPY high, weighing on the Dollar. The main focus for USD traders this week will be on the latest set of US inflation figures due on Wednesday.

Fed Expectations Shifting – Inflation Still Key

The market has shifted its expectations regarding the Fed recently. The majority of players now no longer forecast any further tightening from the Fed this year and are already looking ahead to projected rate cuts in the first half of next year. However, the Fed has reaffirmed its message of data dependent decision making and, as such, should we see any surprise move higher in inflation, this could well lead the bank to hike again this year. Consequently, Wednesday’s data will be key for markets and holds the potential to drive plenty of volatility.

Market Impact

Looking at forecasts for the release, the market is expecting a slight uptick in US inflation which if seen, will likely drive some short-term USD support. However, should we see inflation undershooting targets, this will likely be seen as confirmation that the Fed will stay on hold this year, driving USD lower near-term.

Technical Views

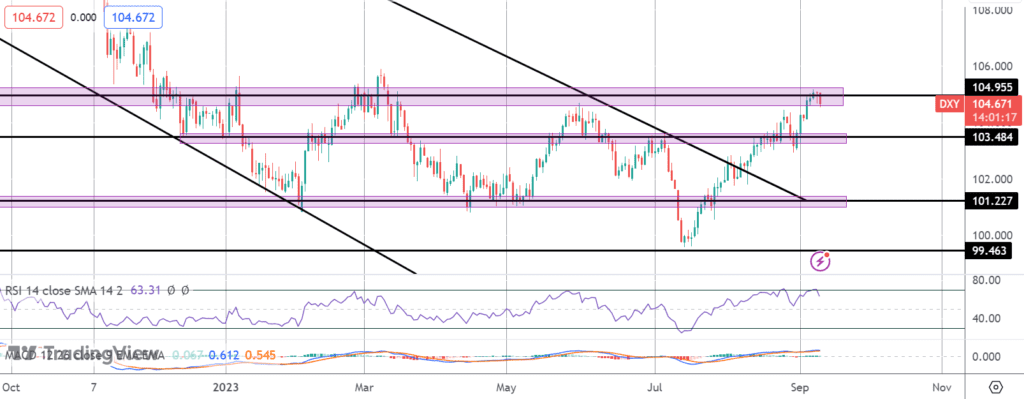

DXY

The index is currently stalled at the 104.95 level. This is a major resistance zone for the market and while this area holds, a correction lower is likely, in line with bearish divergence in momentum studies. To the downside, 103.48 will be the next support to note. Bulls will need to defend this level to maintain a bullish bias medium-term.

Source: Tickmill