EUR Under Pressure

Selling in EURUSD has continued to build on Wednesday with the latest data out of the eurozone showing that inflation in France and Germany slowed more than expected last month. In a further sign that overall eurozone CPI is falling further, EURUSD is pushing lower. Part of this Is the resurgence in hawkish Fed expectations. With the market now widely expecting the Fed to hike rates again next month, capital has been flowing back into the Dollar which has also seen an influx of safe-haven demand recently amidst uncertainty around US debt ceiling negotiations.

ECB Warns Over BOJ Normalisation

Comments from ECB members this week have also added to bearish sentiment in the Euro. In its quarterly financial stability review, the ECB warned that policy normalisation from the BOJ risked putting great strain on global bond markets. A swift repatriation of capital to Japan to capitalise on higher rates would lead to liquidity issues elsewhere, including eurozone banks where bond supply has been higher as a result of ECB easing over the last decade.

ECB Warns Over Liquidity Risks

These comments come on the back of the ECB warning yesterday over the risks around shadow-banking in the eurozone. The ECB warned that lenders faced severe liquidity risks in the event of large level withdrawals from funds or clearing houses and, in particular, shadow-banks. Looking ahead this week, focus will be on the latest eurozone CPI number due tomorrow which is expected to show eurozone CPI falling further last month, leading EUR lower near-term.

Technical Views

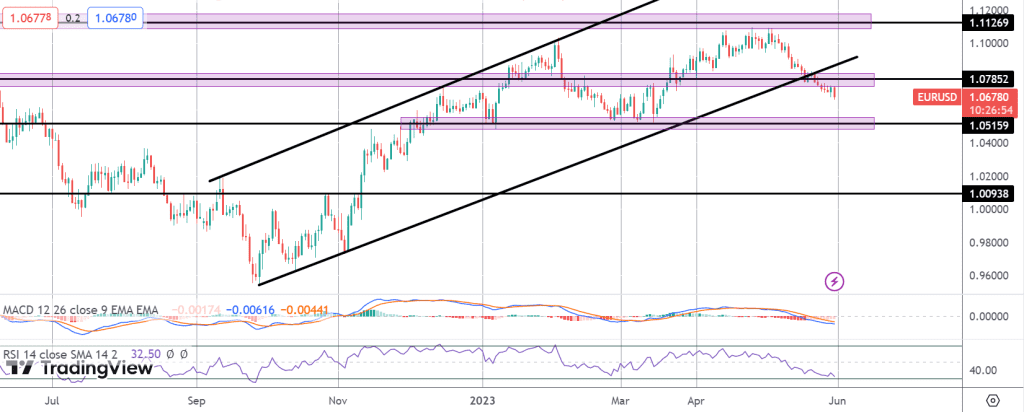

EURUSD

The sell off in the market from highs around 1.11 has seen the pair breaking down through key support at the 1.0785 level and the bull channel lows also. While below this area, and with momentum studies bearish, the focus is on a further push lower and a test of the 1.0515 level support next.

Source: Tickmill