GBP Under Pressure

GBP is turning lower today on the back of comments yesterday from BOE governor Andrew Bailey who noted that BOE rates are likely near their peak. On the back of 14 consecutive rate hikes, the BOE is widely expected to hike rates again later this month. However, on the back of Bailey’s comments, the market now senses that the bank might look to hold beyond the September meeting, weighing on GBP near-term.

Bailey Confident on Inflation Decline

Inflation cooled sharply last month and Bailey reaffirmed his message that the bank expects inflation to fall significantly through year end. With wage growth softening and shop prices cooling, Bailey looks optimistic that things are moving in the right direction. However, there are still upside risks to be monitored. Among these, the recent uptick in energy prices is expected to feed through into higher inflation. However, Bailey believes this to likely be short lived.

August Inflation on Watch

All eyes will now be on the August CPI print due on the 20th, days ahead of the BOE meeting. If inflation is seen cooling further this should confirm a BOE pause beyond September, sending GBP lower. If fresh upside is seen, however, this will likely see GBP remaining supported near-term, keeping the pressure on the BOE.

Technical Views

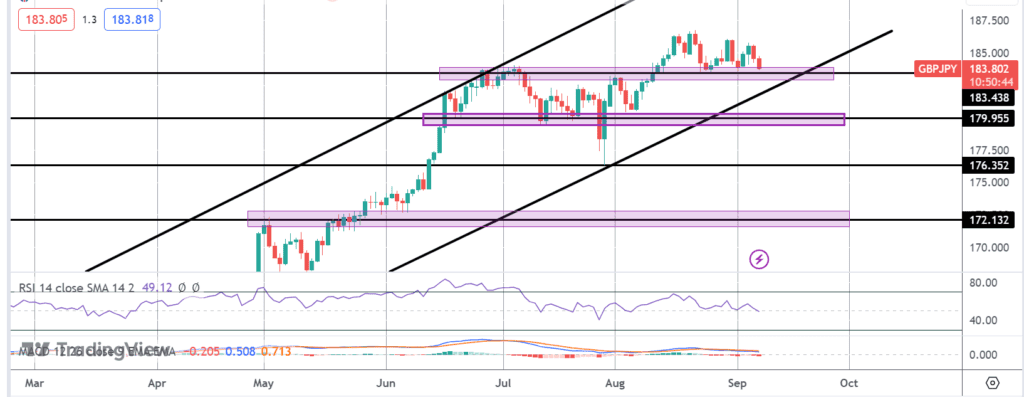

GBPJPY

The rally in GBPJPY has stalled for now on the break above the 183.43 level. Price is now testing the level from above. With momentum studies turning lower, risks are tilted towards a break lower here with the bull channel lows the next support to note ahead of deeper support at the 179.95 level.

Source: Tickmill