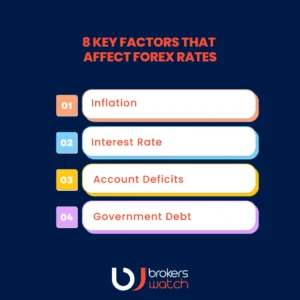

8 Key Factors that Affect Forex Rates

Foreign exchange market is the global market place for exchanging national currencies. Exchange rates are simply the value of one currency in comparison to another and the rate at which each currency can be traded is affect by many factors and have to be considered in every successful trading strategy.

Below are the factors that impact Forex rates:

#1 – Inflation

Any changes in market inflation cause changes in currency exchange rates. If the country’s inflation rate is lower than others, then the currency is expected to appreciate in value compared to a currency with the higher inflation rate.

#2 – Interest Rate

Interest rate is directly tied to inflation. They are work independently from each other. Interest rates are controlled by central banks, and they are used to respond to the negative effects of inflation.

A higher interest rate means more profit for lenders which attracts foreign investors and gradually increases a currency’s value in relation to others.

Both high and low interest rates, are good. Low interest rates can boost economic growth while high interest rates can stop the rapid economic growth. In order for global trade to function efficiently the economic balance must be maintained.

#3 – Account Deficits

A country’s current account is the balance of all goods and services that have been traded with other countries. If a country buys more than it sells, then the balance of trade is a deficit which directly affects the exchange rate as any given country will need more foreign capital than it can afford. Therefore the excess supply of local currency drives down its value against foreign currency.

#4 – Government Debt

This is the total national or public debt owned by the central government. A country with high amount of government debt is less likely to attract foreign investments which is leading to inflation. Foreign investors, if they see that there is an increase in government debt within a given country, they are more likely to invest their bonds in the open market. Consequently, a decrease in the value of its exchange rate will follow.

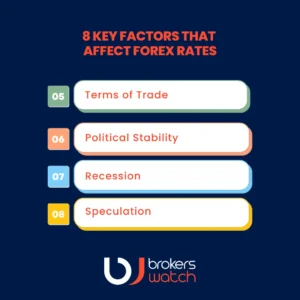

#5 – Terms of Trade

Terms of trade is the ratio of export price. Simply put, when the export price of a country rises at a greater rate than its import prices, then the terms of trade improves. This in turn results in a higher revenue, higher demand for the country’s currency and an increase in the value of the currency.

#6 – Political Stability

One of the many factors that affect the economic performance of a country is also the political stability. A country with a stable political environment it is more appealing to foreign investments. In turn, an increase in foreign capital leads to an appreciation in the value of its domestic currency.

#7 – Recession

If a country experience recession, then the interests rates will drop, and minimizing the chances to acquire foreign capital. As a result the currency weakens relative to other countries and the exchange rate depreciates.

#8 – Speculation

Investors demand more money of a country’s currency when the value of its currency is expected to rise to make profit in the near future. Therefore, the value rises due to its increased demand which consequently results in a rise in the exchange rate, too.