Loonie on Watch

USDCAD is pushing higher today, with the pair testing above the bear trendline and prior 2024 highs, despite the weakness in USD. Concerns over the sustainability of the current risk rally are seeing some unwinding of CAD longs. Traders are also bracing for two sets of key US and Canadian data later today which hold the potential to drive plenty of volatility in the pair.

Canadian GDP

First up, we get the latest Canadian GDP figures which are expected flat at 0.2% month-on-month. The BOC is widely expected to ease rates this year with traders looking for signals as to when expected cuts will likely come. With this in mind, any weakness in today’s data will likely be sharply bearish for CAD as traders bring their BOC rate-cut expectations forward.

US Core PCE Due

Following that data, we then get a look at the US core PCE price index. Given that this is a key inflation gauge for the Fed, there will be plenty of focus on this release, which is expected to rise to 0.4% from 0.2% prior. With CPI having come in above forecasts this month, any strength in today’s reading might well fuel a fresh bid in USD, reversing the recent losses. If this doe slay out, then we can expect the current rally in USDCAD to continue near-term.

Technical Views

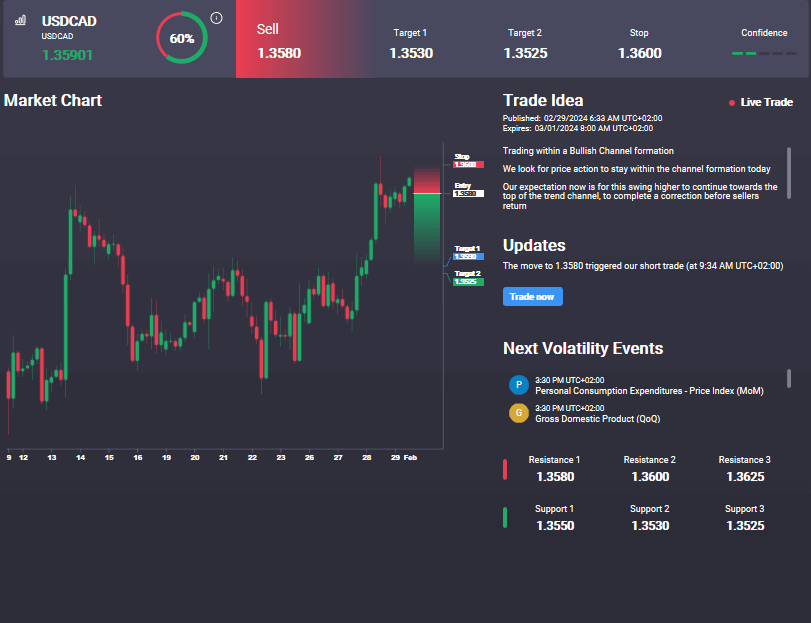

USDCAD

The rally has seen the pair testing above the bear trend line and prior 2024 highs. While above the 1.3501 level and with momentum studies bullish, the focus is on a further push higher with 1.3683 the next target for bulls. Interestingly, the Signal Centre has an active sell signal from 1.3580 targeting a move back down to low 1.35s.

Source: Tickmill