Daily Market Outlook, August 17, 2022

Overnight Headlines

- Biden Signs Inflation Act, Sets 15% Minimum Corporate Tax

- Chipmakers Are Flashing More Warnings On The Global Economy

- Goldman Warns Iran Nuclear Deal Is ‘Unlikely’ After Oil Tumbles

- FX Activity Surges 8% As War And Inflation Risks Fuel Volatility

- Cheney, Republican Who Defied Trump, Loses Wyoming Race

- Biden Admin Weighs EU Plan To Revive The Iran Nuclear Deal

- BoC Governor: Inflation May Have Peaked But Still Too High

- UK Pay Settlements Hold At 4%, Highest Since 1992: XpertHR

- UK Inflation Expected To Rise To Fresh Multi-Decade High

- Japan August Manufacturers’ Mood Rises To 7-Month High

- Australian Wages Pick Up In Q2, Lags Forecasts And Inflation

- RBNZ Hikes Another 50 Basis Points; Sees Higher Rate Peak

- Oil Recovers From Six-Month Lows After US Stockpiles Drop

- Gold Prices Flat As Investors Await Cues From Fed Minutes

- Asian Equity Markets Mostly Higher; Nikkei Outperforms

The Day Ahead

- Asian equity markets are mostly up as the global rally in equities continues. Reports that the Chinese authorities are considering further stimulus measures may have lent support. Oil prices remain under pressure. Brent crude briefly touched below $92bbl, and while it has subsequently bounced, it is still close to a six-month low. In contrast, natural gas prices continue to move higher amid concerns about supplies as autumn approaches. As expected, the New Zealand central bank raised interest rates by 50 basis points and said that rates that are currently 3% could rise to 4%.

- UK inflation data for July showed annual CPI inflation rose by more-than-expected to 10.1% (from 9.4% in June). The ‘core’ rate also rose by more-than-expected to 6.2% from 5.8%. Looking forward, the recent sharp fall in the oil price should put some downside pressure on inflation. However, for the UK in particular, that will be offset by the ongoing rise in natural gas prices. Consequently, headline inflation is expected to rise significantly higher in October when the next Ofgem price cap comes into effect, with the BoE calculating that it could breach 13%.

- Today’s Q2 GDP report for the Eurozone is a second reading. It is not expected to be revised from the initial estimate of quarterly growth of 0.7%. However, it will provide further details on the drivers of growth. Despite Q2’s upside surprise, ongoing concerns about the Ukrainian crisis and the impact on spending power from high inflation still point to downside risks for growth in the second half of the year.

- US retail sales growth has slowed this year and much of the rise that has taken place reflects price rises rather than firmer real terms spending. More positively, sales surprised on the upside in June and a small increase is expected in July, although once again the gain once adjusted for inflation seems set to be relatively modest.

- The minutes of the US Federal Reserve’s July policy meeting will be released today. These have been partially superseded by subsequent developments and updated comments from Fed policymakers have already made their latest position clear. They remain focused on bringing inflation down to target and think further interest rises will be necessary. However, some of the meeting detail may provide new insights. Fed Chair Powell has talked about wanting to see ‘compelling’ evidence that inflation was heading back to target before considering a policy pivot. So, it will be interesting to see whether there is any more detail on what ‘compelling’ means.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0075 (297M), 1.0100-10 (1.13BLN)

- 1.0115-20 (336M), 1.0150 (394M), 1.0175 (367M)

- 1.0190-00 (727M), 1.0270 (254M)

- USD/JPY: 133.00 (228M), 133.50 (210M)

- GBP/USD: 1.2050 (441M). USD/CHF: 0.9380 (315M)

- AUD/USD: 0.7025-30 (556M), 0.7040 (280M)

- 0.7065-70 (284M), 0.7165 (254M)

- USD/CAD: 1.2595 (330M), 1.2855 (515M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.0410

- Steady after closing up 0.1%, supported by cross demand, EUR/JPY +0.8%

- Post Brexit UK friction – dispute resolution over research

- Liz trust, likely next UK PM behind the move – expect conflict if elected

- 20 day VWAP bands expand – signals remain modestly negative

- 1.0115, lower 20 day VWAP and 1.0111 61.8% Jul/Aug rise a base Tuesday

- Support around 1.0100 likely resilient – potential range base

- 1.0150 394 mln, 1.0175 360 mln, 1.0190/00 726 mln Wednesday’s close strikes

- 20 Day VWAP bearish, 5 Day bearish

GBPUSD Bias: Bearish below 1.23

- GBP/USD falls 40 pips from spike high on hot UK CPI data

- Cable spiked to 1.2143 on hotter than expected UK July CPI data

- Up 10.1% YY vs 9.8% f/c…. 1.2103 subsequent pullback low

- 1.2143 was six pips shy of Monday’s high (1.2008 was Tuesday’s low)

- Hot CPI data increases probability of another 50 bps BoE hike in September

- BoE expects CPI to peak at 13.3% in October (2% is BoE’s target level)

- 20 day VWAP bands contract – signals show no significant bias

- Close below 1.2105 was bearish development

- Targets 1.2004 August low then 1.1963, 61.8% July-August rise

- 20 Day VWAP is bearish, 5 Day bearish

USDJPY Bias: Bearish below 136

- Trading remains on thin side due to on-going Japan Obon holidays

- US yields more supportive than not, Treasury 2s @3.266%, 10s @2.820%

- Japan-US 2-year interest rate differential @335.3 bps, 10s @263.4 bps

- Japanese economic data more upbeat into August but BoJ to stay on hold

- Tokyo risk-on, Nikkei +0.9% @29,130, E-Minis @4306, around par

- Massive expiries Thursday however, 132.00 $1.4 bln, 133.90 $652 mln

- USD/JPY trades within the usually resilient 132.06-135.17

- 20 Day VWAP is bullish, 5 Day bullish

AUDUSD Bias: Bullish above .7050

- Under pressure on dovish tilt in RBA expectations

- AUD/USD fell to 0.6988 as market pricing in 25 BP RBA hike instead of 50 BP

- It recovered to 0.7016 when the RBNZ delivered a “hawkish” 50 BP hike

- AUD/NZD selling limited gains and AUD/USD slipped back to 0.6980’s

- Resistance is at Tuesday’s 0.7040 high with sellers around 0.7050

- AUD/USD vulnerable if Fed minutes lean to the hawkish side of expectations

- Offers eyed .7270/30, bids .6950’s

- 20 Day VWAP is bullish, 5 Day bearish

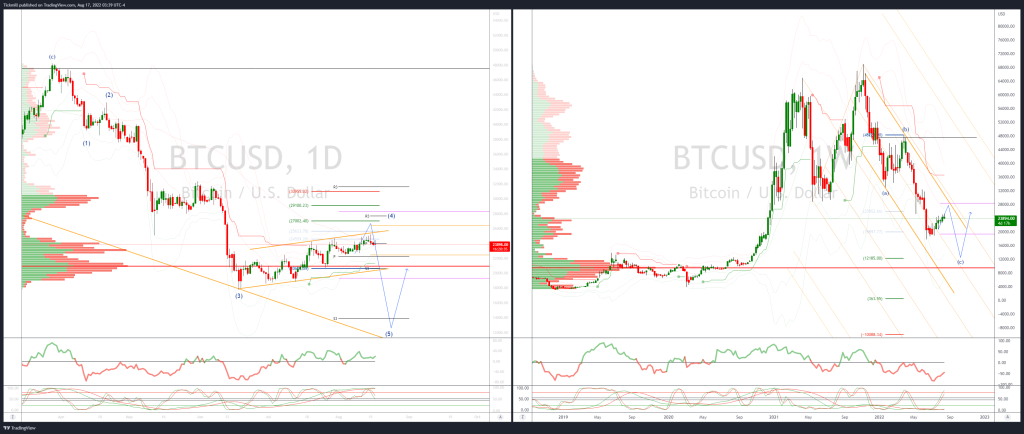

BTCUSD Bias: Bearish below 25.3K

- BTC washed up after failing to cross 25k again

- Closing above 24,665 needed to fuel rally

- Will exit VWAP uptrend channel if below 24,145

- FED issued further guidance for banks considering activities involving cryptocurrencies

- FED told firms they must notify them before and whatever they do is legally permitted

- Bulls need a close above 25k to gain significant upside momentum

- Closing below 21k would be a noteworthy downside development

- 20 Day VWAP is bullish/neutral, 5 Day bearish

Source: Tickmill