Daily Market Outlook, December 15, 2022

-

Asian equities are trading on the backfoot following last night’s more hawkish read from the US Fed policy decision, while the pace of tightening was reduced, with interest rates increasing by 50bp (to a Fed funds rate of 4.25-4.50%) compared with the 75bp hikes at the prior four meetings, the Fed’s latest guidance suggested a terminal rate higher than the committee was previously targeting. The median estimate of Fed policymakers’ forecasts, the so-called ‘dot plot’ suggests a terminal target of 5.00-5.25% in 2023. In the press conference, Fed Chair Powell stated the central bank still had a “ways to go” to defeat inflation.

-

Following the Fed, markets will now focus on policy decisions from central banks across Europe, the Bank of England is expected to announce its latest policy decision at lunchtime in the UK. The guidance given at the last meeting suggested a further limited rise in interest rates with markets pricing a 50bp increase. Markets will parse the decision for any further signs of a split vote as it appears two or possibly three members may prefer a smaller move, given that two Monetary Policy Committee members voted against the previous decision to hike by 75bp, markets will also be keen to understand whether any members are leaning towards a larger rate increase. Today’s meetings will not include BoE updates to its forecasts and there won’t be a press conference. The guidance on further rate moves will likely be claimed to be ‘data dependent.

-

The ECB hiked rates by 75bps at its last two meetings, and recent comments from ECB policymakers infer that they will now slow their pace, with markets pricing a 50bp rate increase today. Some ECB officials have suggested another 75bp rise may be necessary, but it seems as though the hawks may settle for an announcement that Quantitative Tightening will start next year. ECB President Lagarde recently confirmed that details on the principles for balance sheet reduction will be announced today, but it is unclear whether a specific start date will be given or whether some other guidance will be provided. The forward guidance on rates may again be that this is now ‘data dependent’ but that seems unlikely to weigh on expectations for further rate increases.

-

Markets-wise, the action continues to replicate a classic bear market pattern, with gaps higher only to bleed lower, with investors seeking the illusive Fed pivot to end of restrictive monetary policy, once the BoE and ECB are done today it is more than likely that the massive December options expiration due tomorrow will contain the action, with the benchmark S&P500 pinned to the 4000 level as the price where the largest amount of options interest is set to expire, investors will look to next week with no further meaningful macro data, will Santa finally be on his sleigh ready to deliver the year-end boost to stocks?

Overnight Headlines

-

China Economic Activity Slumps With More Disruption To Come

-

PBoC Injects Net 150Bln Yuan Via MLF; Rate Kept Unchanged

-

Japan’s Trade Balance Deficit Narrows Less Than Expected

-

NZ Economy Grows Strongly In Q3, But Recession Clouds Ahead

-

Powell Sees Rates Higher For Longer, But Market Doesn’t Buy It

-

House Passes One-Week Spending Bill To Avert Dec. 17 Shutdown

-

ECB To Slow Rate Hikes And Lay Out Plans To Drain Cash

-

Bank Of England Readies Another Rate Hike Even As Recession Hits

-

Oil Declines After Section Of Major Keystone Pipeline Restarts

-

Stocks Extend Drop In Asia On Fed; US Dollar Advances

-

Elon Musk Sold More Than $3.5 Billion Worth Of Tesla Shares

-

Warner Bros. Discovery Lifts Writedown Costs To $5.3 Billion

-

Ford, China’s CATL Mull Workaround For New US Battery Plant

-

SEC Proposes Rules That Would Squeeze Stock-Market Middlemen

FX Options Expiring 10am New York Cut

-

EUR/USD: 1.0415-30 (1.06BLN), 1.0450 (1.93BLN)

-

1.0500 (237M), 1.04530 (201M), 1.0550 (426M)

-

1.0570-80 (419M), 1.0600 (337M), 1.0700 (1.15BLN)

-

EUR/JPY: 146.00 (612M)

-

USD/CHF: 0.9395-00 (628M)

-

GBP/USD: 1.2350 (435M), 1.2495-00 (549M)

-

AUD/USD: 0.6600 (302M), 0.6755-70 (479M)

-

NZD/USD: 0.6300 (200M), 0.6400 (200M)

-

USD/CAD 1.3500 (439M), 1.3850 (249M)

Technical & Trade Views

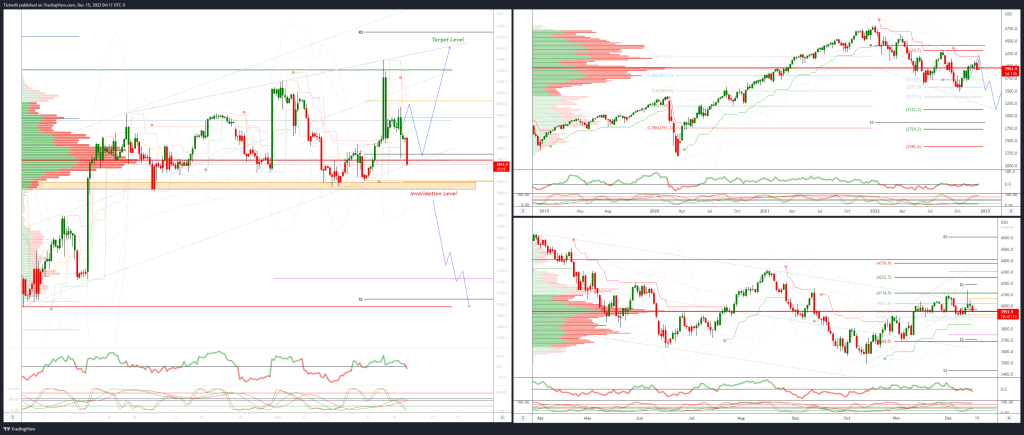

SP500 Bias: Bullish Above Bearish Below 3950

4120 Target Achieved, New Pattern Emerging

-

Primary support is 3950

-

Primary upside objective is 4150

-

Failure at 3950 opens a test of 3900

-

20 Day VWAP bullish, 5 Day VWAP bullish

EURUSD Bias: Bullish Above Bearish below 1.05

1.0620 Target Achieved, New Pattern Emerging

-

Primary support is 1.0590

-

Primary upside objective is 1.07

-

Failure at 1.05 opens a test of 1.04

-

20 Day VWAP bullish, 5 Day VWAP bullish

GBPUSD Bias: Bullish Above Bearish below 1.2250

-

Primary support is 1.2250

-

Primary upside objective 1.24

-

Failure at 1.2080 opens a test of 1.2030

-

20 Day VWAP bullish, 5 Day VWAP bullish

USDJPY Bias: Bullish above Bearish Below 137.70

-

Primary resistance is 137.70

-

Primary downside objective is 132

-

Acceptance above 138 opens a test of 139.30

-

20 Day VWAP bearish, 5 Day VWAP bullish

AUDUSD Bias: Bullish Above Bearish below .6700

-

Primary support is .6700

-

Primary upside objective is .6900

-

Failure at .6700 opens a test of .6600

-

20 Day VWAP bullish, 5 Day VWAP bearish

BTCUSD Bias: Intraday Bullish Above Bearish below 17500

18200 Target Achieved, New Pattern Emerging

-

Intraday 17500 is primary support

-

Primary upside objective is 18500

-

Failure at 17400 opens a test of 17200

-

20 Day VWAP bearish, 5 Day VWAP bullis

Source: Tickmill