Daily Market Outlook, November 7, 2022

“ A whipsaw end to the week in the US on Friday, following the mixed Non Farm payrolls release which saw the Dollar post one of its largest declines in the past seven years. Chinese authorities did little to boost risk appetite as they reaffirmed their commitment to zero Covid policies over the weekend, this restatement came as infections in the region rose to the highest levels since May. Overnight data out of China also confirmed a softer trade surplus as tepid global demand continues to weigh on exports, however, even against this backdrop Asian equity markets have retained a firmer tone overnight and US futures are pointing to a positive start to the week. The week ahead will be dominated by US midterm election results on Tuesday evening, followed by US inflation on Thursday. The midterm elections are seen as a close call, with the Republican party seen as favourites to secure control of the Congress, with the Senate race seen as too close to call, historically, markets prefer political gridlock, if the Republicans seize control of both houses this would significantly hamper Biden’s fiscal plans and likely put the ball back into the Fed’s court, with respect to providing economic support, this would most likely be interpreted as having dovish connotations for Fed policy and a positive for markets. Thursday’s CPI release is likely to confirm a month on month increase of 0.5% which will leave inflation as the Fed’s principal cover for higher rates for longer, for those looking for signs of peak inflation, prints closer to 0.2% month on month will be needed to confirm a turn, once again supporting the promise of a future Fed pivot, which has proved elusive so far…see more of my thoughts on the week ahead in my weekly market outlook video”

Overnight Headlines

-

Fed Watchers Put ‘Finger In The Air’ And See Rate Peak Above 5% – BBG

-

Economy Of Extremes Looms Over US Voters On Midterm Election Eve – BBG

-

Democrats Catch Up To GOP On Enthusiasm In Final Poll Before Midterms – NBC News

-

Following The Fed Goes Out Of Fashion In ‘Messier’ World Economy – BBG

-

BlackRock’s Rieder: Fed May ‘Overdo It’ With Rate Increases – BBG

-

Biden Predicts Democrat Midterms Win, Says Economy Improving – RTRS

-

Biden And Trump End Midterms On 2024 Collision Course – Politico

-

Dollar Gains As China Sticks To Stringent Covid Policy, Souring Risk Sentiment – RTRS

-

More Pound Pain Coming As BoE Shifts To Recession From Inflation – BBG

-

China Ends Stronger-Than-Expected Yuan Fixings Amid Covid Bets – BBG

-

Crypto ‘FOMO Effect’ Emboldens Bulls; Bitcoin Topped $21,000 Again – BBG

-

Ethereum Insiders To Get Fee Cuts That Others Won’t In Upgrade – BBG

-

Gold Retreats From Three-Week High As Firmer Dollar Dulls Appeal – RTRS

Technical & Trade View

SP500 Bias: Intraday Bullish Above Bearish Below 3800

Technicals

-

Primary resistance is 3800

-

Primary downside objective is 3680

-

Next pattern confirmation, acceptance below 3700

-

Acceptance above 3810 opens a test of 3835

-

20 Day VWAP bullish, 5 Day VWAP bearish

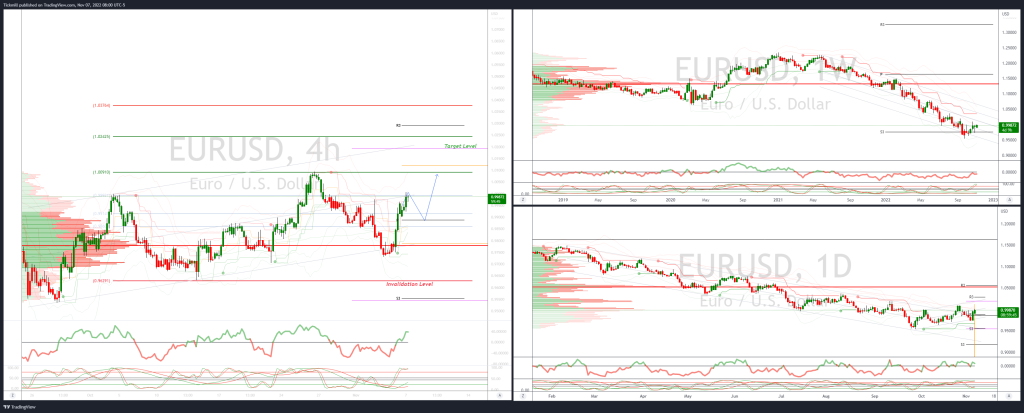

EURUSD Bias: Intraday Bullish Above Bearish below .9860

Option Expiries: 0.9750 (1.19BN), 0.9800 (1.88BN), 0.9820-25 (430M), 0.9850-60 (732M), 0.9880 (470M), 0.9935-45 (743M), 0.9950-55 (648M), 0.9975-80 (310M), 1.0000 (442M)

Technicals

-

Primary support is .9860

-

Primary upside objective is 1.02

-

Next pattern confirmation, acceptance above 1.00

-

Failure below .9700 opens a test of .9630

-

20 Day VWAP bearish, 5 Day VWAP bearish

GBPUSD Bias: Intraday Bullish Above Bearish below 1.1260

Option Expiries: 1.1460-70 (493M), 1.1665-75 (494M)

Technicals

-

Primary support is 1.1260

-

Primary upside objective 1.20

-

Next pattern confirmation, acceptance above 1.15

-

Failure below 1.1240 opens a test of 1.1150

-

20 Day VWAP bearish, 5 Day VWAP bullish

USDJPY Bias: Intraday Bullish above Bearish Below 148.10

Option Expiries: 148.00 (410M), 148.60-62 (730M)

Technicals

-

Primary resistance is 148.10

-

Primary downside objective is 143.25

-

Next pattern confirmation, acceptance below 146

-

Acceptance above 148.50 opens a test of 149.70

-

20 Day VWAP bearish, 5 Day VWAP bearish

AUDUSD Bias: Intraday Bullish Above Bearish below .6380

Option Expiries: 0.6425-30 (990M), 0.6450 (650M), 0.6500 (308M)

Technicals

-

Primary support is .6380

-

Primary upside objective is .6590

-

Next pattern confirmation, acceptance above .6520

-

Failure below .6350 opens a test of .6280

-

20 Day VWAP bullish, 5 Day VWAP bullish

BTCUSD Bias: Intraday Bullish Above Bearish below 20000

21460 Target Achieved, New Pattern Developing

Technicals

-

Intraday 20000 is primary support

-

Primary upside objective is 22863

-

Next pattern confirmation, acceptance above 21460

-

Failure below 20000 opens a test of 19.750

-

20 Day VWAP bullish, 5 Day VWAP bullish

Source: Tickmill