UK Inflation Jumps in Feb

The latest set of UK inflation figures has thrown a spanner in the works for the BOE ahead of tomorrow’s keenly awaited March rates meeting. Traders had been increasingly expectant that the BOE might pause rates this time around, or hike by a smaller .25% and signal a pause thereafter. This view was predominantly driven by the recent declines in inflation which had fallen back from 11.1% to 10.1% in January. Additionally, the recent banking sector liquidity issues which have gripped markets were also seen as a good case for the BOE holding off from further rate hikes.

However, February CPI released this morning shows that prices moved sharply higher last month, contrary to expectations. Headline CPI jumped back up to 10.4% last month, up from 10.1% prior and in stark contrast to the 9.9% the market was looking for. Similarly, core CPI which was expected to print 5.7%, down from 5.8% over the prior month, was seen rising back to 6.2%.

Food & Alcohol Prices Surge

Looking at the breakdown of the data, the ONS reported that the biggest increases were seen in fresh food and alcoholic beverages which rose to their highest level in 45 years. These came alongside a spike in restaurant prices and women’s clothing also.

UK Bucks the Trend

While inflation in the eurozone and US was seen falling last month, a fresh uptick in UK prices raises serious questions over the UK growth outlook this year. With risks around the ongoing banking sector liquidity situation and the cost-of-living crisis still gripping the UK and the BOE now likely to have to push ahead with rate hikes for longer than planned, growth forecasts over the rest of the year look under threat.

Uncertainty Ahead of BOE

With a .25% hike now the base case scenario, traders will be focused firmly on the BOE’s forward guidance. Given the three months of inflation declines prior to this data, the BOE might choose to look at the increase as a blip and wait until the next CPI reading before becoming too concerned. The bank has previously made clear its desire to move away from tightening and is likely to reaffirm this message tomorrow. However, if the bank is seen adopting a more concerned tone around inflation this will likely weigh on UK assets near-term

Technical Views

FTSE

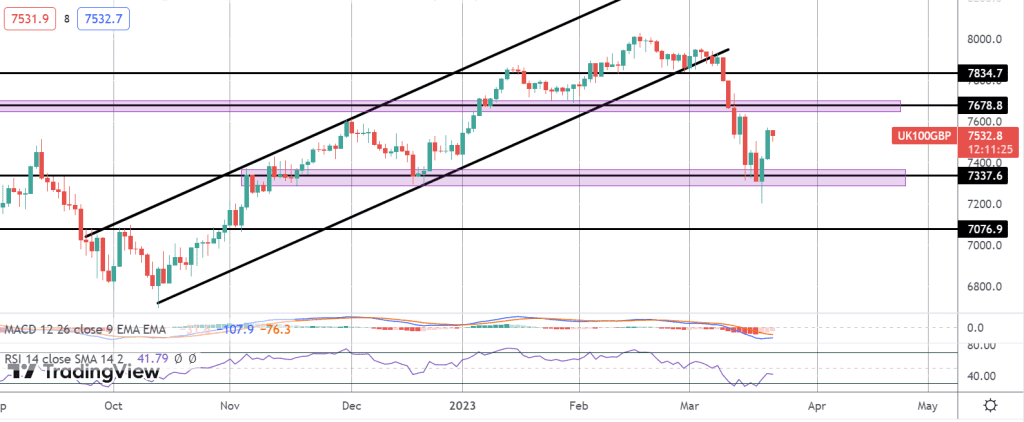

The breakdown below the rising channel saw price trading as low as a test of the 7337.6 level. Price pierced below the level briefly before reversing and is now trading back up towards the 7678.8 level Momentum studies are turning higher off lows. However, unless bulls can get back above 7678.8, risks of a fresh move lower are seen.

Source: Tickmill